The Governing Mandate

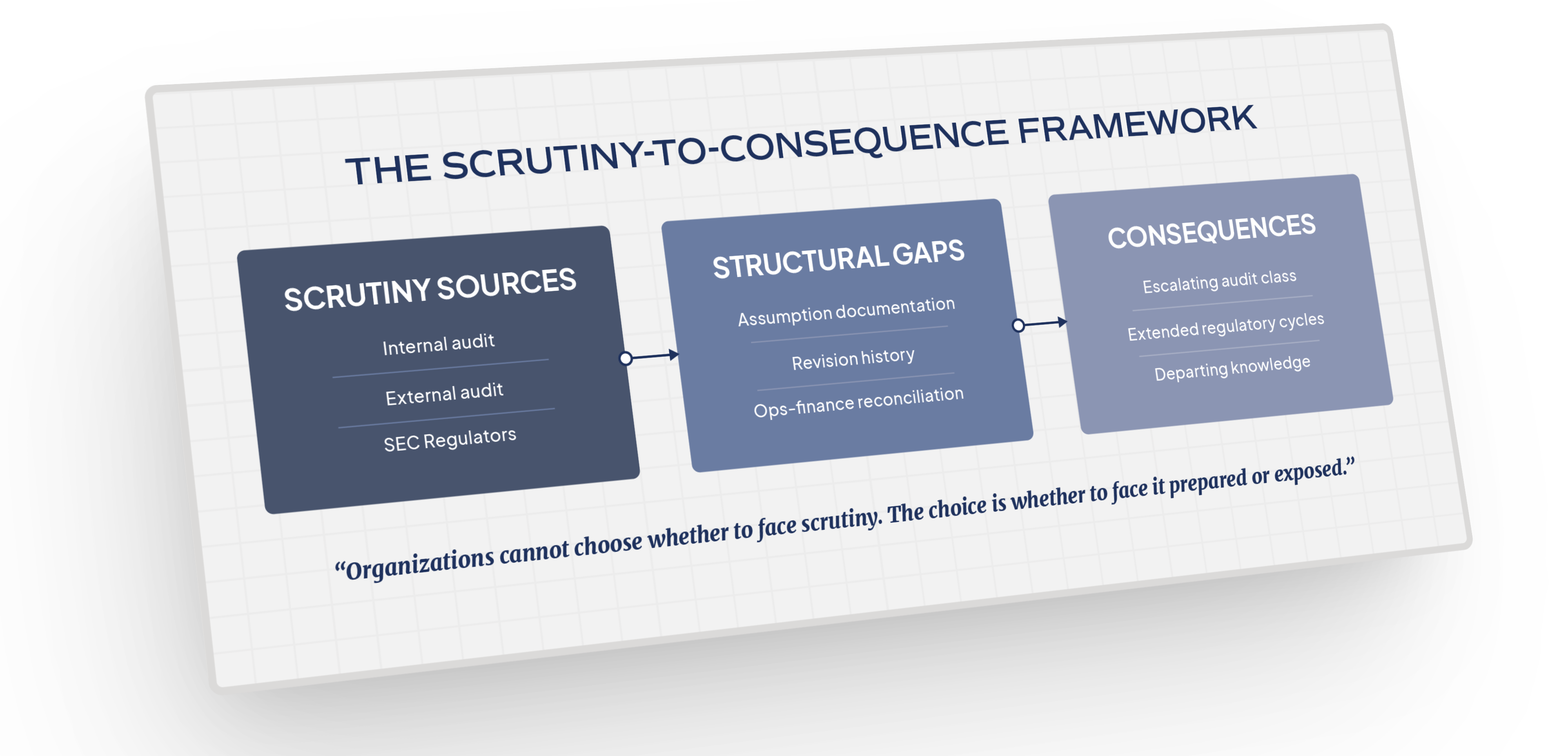

Environmental Obligations attract scrutiny by design. Internal auditors examine them because control weaknesses in high-value liability accounts represent enterprise risk. External auditors examine them because Environmental Obligations involve significant estimates and judgments that directly affect financial statements. Regulators examine them because accurate disclosure of Environmental Obligations is a securities law requirement and a matter of public interest. This scrutiny is not episodic. It is continuous and intensifying.

The governing mandate is straightforward. Scrutiny reveals what systems capture and preserve, not what organizations believe they capture or assume can be reconstructed later. When internal audit tests controls over estimate revisions, the evidence produced demonstrates whether governance exists in practice or only in policy. When external auditors request the basis for Environmental Obligation estimates, the supporting information produced reflects the true state of traceability. When regulators seek clarification on disclosures or contingencies, the response exposes whether recognition and measurement decisions are systematically documented or manually reconstructed.

Organizations cannot choose whether Environmental Obligations will be scrutinized. They can only choose whether scrutiny finds them prepared or exposed.

The Structural Breakdown

Most organizations face audit and regulatory scrutiny exposed. The gaps in traceability uncovered by auditors and regulators follow consistent patterns driven by process and system limitations rather than intent.

Missing and Incomplete Assumptions: The first gap is assumption documentation. Auditors routinely ask which assumptions support recognition decisions and measurement of Environmental Obligations, and how those assumptions were determined. PCAOB AS 2501 governs this evaluation. Many organizations struggle to connect specific assumptions to supporting evidence, including scientific data, third-party documentation, regulatory correspondence, and historical analyses. Assumptions may exist, but the linkage to source evidence is incomplete or informal.

No Preserved Revision History: The second gap is revision history. Auditors and regulators evaluate not only the current liability balance but how it evolved over time. They ask what changed between reporting periods and why. Organizations that rely on spreadsheets cannot answer these questions systematically because prior states are overwritten rather than preserved. Responses require reconstruction from partial records, emails, and institutional memory.

Reconciliation Gaps Between Finance and Operations: The third gap is reconciliation. Finance records Environmental Obligation balances and period activity. Other functions maintain obligation-related factual inputs that inform status and estimates. Auditors expect these perspectives to reconcile so that reported balances reflect the underlying obligation reality. When data resides in disconnected systems, reconciliation becomes a manual, time-constrained exercise during close and audit cycles.

These gaps are structural. They persist because traceability is not governed within a single system of record.

EXPLORE ENFOS TODAY

The Strategic Consequences

Scrutiny is unavoidable. When traceability gaps exist, the consequences compound.

Audit Cost Escalation: When evidence cannot be retrieved systematically, auditors expand procedures, request additional samples, and increase substantive testing. External fees rise. Internal support hours increase. The same gaps resurface each cycle because the underlying structure remains unchanged.

Extended Regulatory Exposure: Organizations that can produce complete, traceable documentation resolve regulatory inquiries and proceed. Organizations that cannot enter extended correspondence cycles that consume executive attention and, when unresolved, require additional disclosure or corrective action.

Erosion of Financial Reporting Confidence: When Environmental Obligation balances cannot be traced through assumptions, revisions, and supporting evidence, confidence in reported liabilities declines. Audit outcomes become less predictable, and disclosure risk increases.

Loss of Institutional Knowledge: When assumptions and decisions are not preserved systematically, critical knowledge resides with individuals rather than systems. As personnel change, organizations inherit Environmental Obligations they cannot fully explain to auditors, regulators, or their own leadership.

Traceability gaps rarely surface proactively. They are exposed under scrutiny, when correction is most disruptive.

Category Implication

Audit-ready traceability is not achieved through policy statements or manual reconstruction.

Environmental Obligation Management defines the discipline required to preserve assumptions, evidence, and decision history across the lifecycle of Environmental Obligations within a single, governed system of record. That structure enables organizations to respond to audit and regulatory scrutiny with retrieval rather than reconstruction.

Without governed traceability, audit effort escalates, regulatory exposure increases, and confidence in financial reporting erodes over time. Environmental Obligation Management exists to ensure that Environmental Obligations remain transparent, defensible, and auditable for as long as they remain on the balance sheet.

.webp)